Greetings Comrades!

From time-to-time, a fellow National Socialist is kind enough to provide insightful and important articles for me to share with you. Without further ado:

Do We Still Need Central Banks?

by Dan Schneider

Do we really need central banks like the Federal Reserve? The answer to that is yes and no.

First, the Federal Reserve Bank is a privately owned, for profit bank. It is not traded on the stock market so the identity of the stock holders is confidential. The Fed controls our money supply and decides what interest rates will be and we have no idea who really owns it. For all we know, foreigners could own our central bank and they most likely do. Imagine that! The economy of the United States is most likely dictated by foreigners!

I’m sure you’re aware that every single denomination of currency has the words “Federal Reserve Note” on them. That tells us that the institution that printed it is the Fed. It’s the same with central banks all over the world. They are all privately owned – perhaps by the same people, and they control the economies of their various countries.

How did all this begin? No one knows for sure, but a prime example of how it began takes us back to ancient Israel. In order to get into their synagogues, Jews had to pay a temple tax. The only currency accepted was silver coins known as shekels. The reason for this is most other coins had the images of people or animals engraved on them. As the Torah states, “Though shalt not make unto thee any graven image.” The shekel has only the Hebrew symbol for the letter “S” on one side, and the symbol for one half or one on the other. No graven images.

Shekels were limited in number. It occurred to some people that if they acquired all the shekels, they could sell them at whatever price people could afford to pay or else they wouldn’t be able to get into their synagogues. That’s what the Bible means by “moneychangers”. They would sell shekels to the Jews and the Jews would pay with whatever currency was accepted. Around the time of Christ the most commonly used coin outside of the shekel was the Roman ducat (DUCK-et).

Those who controlled the shekel controlled the entire economy.

Now we jump forward to the Medieval Period in Europe. The primary currency was gold, silver, and copper coins. Those who controlled those metals controlled the economy. Now it’s safe to assume that the wealthy had their own vaults or some other secure place to store their gold. The poor had little or no gold so they didn’t need vaults. The middle or merchant class did. However, they often didn’t have enough gold to make their own vaults worth the expense.

Goldsmiths had vaults for obvious reasons. For a small fee, people could store their gold with the goldsmith. He gave them a receipt for their gold, payable to the bearer, regardless of who presented the receipt.

The Goldsmiths soon realized that very seldom did people come in and demand all their gold, so they began making loans using other people’s gold. This was technically illegal – but only if they’re caught. They charged a fee for the loans, but no interest as the Catholic Church had laws forbidding usury, and interest was considered usury. Penalties for late payments were permitted.

Also, as the receipts that were given to the customers were payable to the bearer, many people started making purchases and using these receipts as money. This was the beginning of writing checks for payment.

The next stage was the formation of banks. Anyone could come in and deposit any kind of currency and receive receipts – sometimes several smaller receipts rather than one large one which made using them for payments more convenient. The banks also made loans for a fee, but still without interest.

As time went on the Church lost more and more of its power and influence and interest rates on loans began and banks prospered. The largest bank in the world at that time was the Bank of England.

Around the year 1100, King Henry I wanted to get control of the money supply from the banks. The only way he could do this was to start his own form of currency using a material not controlled by the bank. He began what is known as the Tally Stick System. These were strips of common wood. They were split down the middle. Each side had a certain number of notches carved into them to denote their value. The government retained one half to guard against counterfeiting, the other half went into circulation.

Henry decreed that people could only pay their taxes using Tally Sticks. This gave them value. Soon, the sticks began to be used as general currency. The economy and the people began to prosper while bank profits declined. The bankers weren’t too happy about this, but there was nothing they could do about it.

The Tally Stick System continued until the late 1500s when King Henry VIII decreed that taxes could be paid in any form of currency. This returned the lost power back to the bankers, however the Tally Stick System continued until the early 1800s when the Bank of England was able to coerce King George III to remove them from circulation. Now the Bank of England’s power was completely restored and the people grew poor again.

They use basically the same system today, except it’s paper money called pounds.

During the Colonial Period in America, times were hard. The people were poor and getting poorer. Bearing in mind the Tally Stick System, the Colonial Government started their own paper currency independent of the Bank of England. This was technically legal.

The system worked well. Inflation ended and the colonies and the people prospered out of the reach of the Bank of England. The bankers couldn’t allow this. King George had racked up a lot of debt in the wars against France and Spain, and the Bank of England threatened to call in his loans unless he outlawed Colonial Script. This he did, and it wasn’t too long before inflation was high, and the people grew poor again.

This wasn’t enough for the B of E. They wanted to make back any money they lost because of Colonial Script. They called in some of King George’s loans, and he had no choice but to overtax the colonies to pay them. This of course caused the American Revolution. The B of E didn’t think the Colonies would ever rebel, but still they made a tidy sum on more loans to King George, even if they did end up losing their investments in the colonies.

During our own Civil War, Lincoln was finding it difficult to come up with enough money to pay his troops. Although there was no central bank in America at this time, regular banks were delegated the task of managing our nation’s currency. Different banks were responsible for different regions. For example, the Southwest was under the jurisdiction of the Bank of Carson City (Nevada).

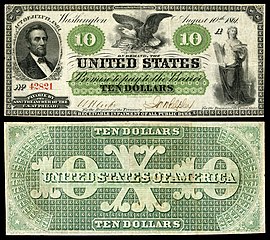

The congress proposed we start our own currency independent of the banks in order to pay our soldiers. Lincoln signed the bill into law and the treasury began printing Treasury Notes. They looked a lot like bank notes except the backs were green, hence the nickname “Greenbacks”.

At first the banks made little noise about this because it was just being used to pay our soldiers, and therefore there wouldn’t be that many in circulation. However, production of greenbacks increased and the bankers started to grumble. They assumed the greenback system would end when the war ended but it didn’t. Lincoln refused to remove greenbacks from circulation and kept on producing more. A few months later, Lincoln was assassinated by John Wilkes Booth, an actor who was also a bank investor. Anyone putting two and two together yet? Let me spell it out. Greenbacks plus Lincoln equals assassination.

When Andrew Johnson succeeded Lincoln, he agreed to stop production of greenbacks, but he wouldn’t remove them from circulation. A few years later congress attempted to impeach Johnson on trumped up charges. He was convicted in the House but the Senate acquitted him. I don’t have to spell it out again, do I?

Greenbacks remained in circulation until 1915.

In December of 1913 several businessmen met in secret in a resort on Jeckyll Island, Georgia. There they drafted a bill for congress. Not one of them was a congressmen. They submitted the bill three days before Christmas when all but three congressmen had gone home for the holidays. It passed unanimously. The same story for the Senate. Woodrow Wilson signed the bill into law December 24, 1913. It was to take effect January 2, 1914. It was called the Federal Reserve Act.

Since the founding of the Federal Reserve Bank 109 years ago, we have become financial slaves to private bankers. With the advent of Globalism we have the World Bank and the International Monetary Fund and their strangle hold has only increased. But there is a way out. Our leaders simply refuse to do it. I wonder why?

When the Federal Reserve Act was passed, we delegated the managing of our finances to a central bank. The Constitution states that the managing of our finances is reserved to Congress, but that does not prevent Congress from jobbing out that task to private banks. On the other hand, it does not prevent the United States government from once again producing Treasury Notes like Lincoln’s Greenbacks.

Economist Graham Summers has stated that if we begin a system like Lincoln’s Greenbacks in 21st Century America, we could pay off the national debt in three years.

Well, why don’t we? Today’s banks use a system called Fractional Reserve Banking. That means they can loan out 90 percent more money than they actually own. That means using the money of their depositors and investors.

Under a system like the Greenback System, banks could only loan money that they actually own. Most economists say this would cause another depression because businesses need loans to keep going. Under a system like the Greenbacks, there wouldn’t be enough money to loan out.

This is an out and out lie. Under a Greenback System there would be more money in the economy and banks would have more money to loan, plus with more money circulating, businesses wouldn’t need as many loans.

Now wouldn’t more money in circulation cause inflation? Not if safeguards were used by the government. You figure out how much money to put into circulation by taking the number of workers, the average wage, plus the average amount of consumption to determine how much to put into circulation.

The most modern example of this was NS Germany. The Reichsmark was completely outside the control of the international bankers and the German people prospered. This is why Hitler and National Socialism had to be destroyed.

There is no legal reason why we cannot start a system independent of the international bankers. Again I ask, why don’t we? You know the answer to that one. But do we still need central banks? The answer to that is yes. Our economy is so large we need a central bank to keep things from becoming chaotic. But as in NS Germany, the bank should be run by the government, and not by private banker out to line their own pockets at our expense.

It is time that the people took back control over their own finances. Julius Caesar said that money should serve the people, not enslave them. When he refused to bow to the moneychangers, he ended up assassinated because he was a “dictator”. Odd how they assassinated a dictator only to replace him with an emperor. Officially, the emperor was Augustus Caesar, Julius’s nephew. But the real ruler was cash. Cash is king.